The average UK property price dropped by 0.3% in June according to Righmove - but Yorkshire and The Humber was one of the few regions that bucked the trend.

In June, the average asking price for UK homes dropped slightly by 0.3% to about £378,240 because more homes came onto the market.

Yorkshire and The Humber was one of the few areas where prices actually rose a little by 0.2%.

Prices there are now nearly 2% higher than last year, with the average home costing around £258,839.

In contrast, many parts of southern England and London saw bigger price drops due to higher stamp duty and more homes for sale.

Despite these changes, buyer interest remains strong. More homes are being sold compared to last year, and there are more homes available to choose from.

In Yorkshire, the average selling price is close to the asking price, and more homes are selling than before.

Overall, the market looks positive for buyers, with plenty of homes for sale and strong sales activity.

Patrick McCutcheon, head of residential at Dacre, Son & Hartley, said:

“In Yorkshire in 2025 our average sale agreed price to asking price remains at around 98.5%.

"We also have around 20% more homes for sale compared to this time last year and our sales volumes are up by approximately 30%.

"Ultimately, well-presented and attractive properties marketed at the right price are selling.”

Pilot dies following aircraft crash near Masham, police confirm

Pilot dies following aircraft crash near Masham, police confirm

Ripon's Portly Pig to host charity football tournament

Ripon's Portly Pig to host charity football tournament

Council to review parking charges across North Yorkshire

Council to review parking charges across North Yorkshire

Free packed lunches at Starbeck café feed families in need

Free packed lunches at Starbeck café feed families in need

Harrogate dentist recognised at national dental awards

Harrogate dentist recognised at national dental awards

Knaresborough beeswax candle shop set to close

Knaresborough beeswax candle shop set to close

Harrogate Town launches new half-time crossbar challenge

Harrogate Town launches new half-time crossbar challenge

Queen and ABBA tribute acts to headline Harrogate Beer Festival

Queen and ABBA tribute acts to headline Harrogate Beer Festival

Ripon entrepreneur to appear on Dragon's Den

Ripon entrepreneur to appear on Dragon's Den

Harrogate figures to be 'jailed' to raise money for Harrogate Theatre

Harrogate figures to be 'jailed' to raise money for Harrogate Theatre

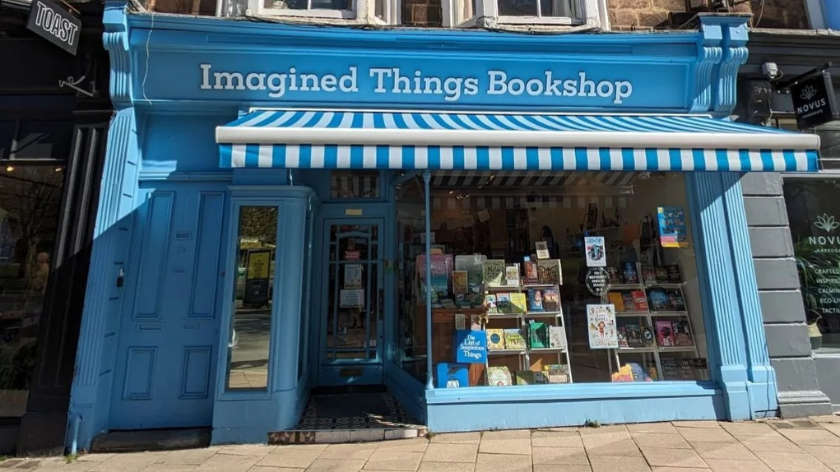

Harrogate bookshop named as finalist for British Book Awards

Harrogate bookshop named as finalist for British Book Awards

Council update on operator of Alpamare water park

Council update on operator of Alpamare water park

Visitor levy would be mayor's decision, says senior councillor

Visitor levy would be mayor's decision, says senior councillor

Date announced for return of Harrogate dog show

Date announced for return of Harrogate dog show

Harrogate's Italian community donates sensory kits worth £1,200 to Harrogate Hospital

Harrogate's Italian community donates sensory kits worth £1,200 to Harrogate Hospital

Man taken to Leeds General infirmary following aircraft crash in Masham

Man taken to Leeds General infirmary following aircraft crash in Masham

Six arrested following car theft in Harrogate

Six arrested following car theft in Harrogate

FULL CHAT: Local occupational therapist hosts online masterclass to support new mums

FULL CHAT: Local occupational therapist hosts online masterclass to support new mums

Harrogate businesses reject new accommodation BID proposal

Harrogate businesses reject new accommodation BID proposal

New interior showroom to open on Albert Street

New interior showroom to open on Albert Street