Council chiefs say they have no choice but to raise council tax by the maximum allowed after receiving a £43m "wallop" in cuts from the government.

Members of North Yorkshire Council’s executive committee have agreed to recommend a 4.9 per cent increase in the authority’s share of the precept when the full council meets next week.

Deputy leader Gareth Dadd, executive member for finance and resources, said a loss of around £20m in the government funding settlement for 2026/27 followed previous cuts last year.

He said:

“If we take into account the fair funding review, the loss of the rural services grant last year, plus the net cost to this authority from the rise in employers’ National Insurance contributions, we are looking at a £43m wallop.”

Cllr Dadd said the authority would have needed to increase its precept by seven per cent to balance the budget by council tax revenue alone.

Instead, the senior councillor said the shortfall would need to be met by savings and money from the authority’s reserves.

He added:

“You can see immediately the problem that we’re facing. That’s why we’ve got savings programs of £56m over the next three years and why we are recommending the maximum amount of tax increase.

“Each one per cent reduction in that council tax increase would add a further £5m per year to the deficit, so play with that figure at your peril.”

The committee heard the authority was still facing a £17m shortfall 2027/28, which rises to around £25m in 2028/29.

Cllr Dadd said the deficit would be far higher had savings not been made due to local government reorganisation in 2023.

He added:

“Make no mistake, local government reorganisation was financially necessary and it’s avoided this council being in the field of up to 74 councils that are seeking exceptional financial support up and down the country.

Councillor Mark Crane, executive member for open to business, said he did not come into politics to raise council tax, but the authority had no choice this year.

He said:

“I can’t just let it go, the amount of money the government’s taking off of us.

“Sorry, but to lose over £40m in the last couple of years, I do not see how they think we can do anything other than raise council tax by the maximum amount.”

A 4.9 per cent increase in council tax would raise the average Band D council tax by £96.78 per year, or £8.07 per month.

It would result in an overall average Band D level of £2,036.32 for 2026/27 before taking into account other precepts for parish and town councils, and the police and fire service.

Harrogate dad takes on 40,000-mile yacht race for bereavement charity

Harrogate dad takes on 40,000-mile yacht race for bereavement charity

Harrogate BID backs return of town's popular Restaurant Week

Harrogate BID backs return of town's popular Restaurant Week

Cost of Harrogate garden bin licence revealed

Cost of Harrogate garden bin licence revealed

Spirit of Harrogate to enter administration

Spirit of Harrogate to enter administration

Call for council to support pubs and hospitality businesses

Call for council to support pubs and hospitality businesses

Ripon MP says Kex Gill realignment scheme is making 'good progress'

Ripon MP says Kex Gill realignment scheme is making 'good progress'

Northern Powergrid issue update on Leeds Road traffic lights

Northern Powergrid issue update on Leeds Road traffic lights

Sir Stephen Fry sends mental health message to Harrogate College students

Sir Stephen Fry sends mental health message to Harrogate College students

Harrogate Cat Rescue appeals for urgent support as vet bills soar

Harrogate Cat Rescue appeals for urgent support as vet bills soar

Cuts may be needed to balance budget at North Yorkshire Police

Cuts may be needed to balance budget at North Yorkshire Police

Harrogate BID unveils full programme for town's Self Care Week

Harrogate BID unveils full programme for town's Self Care Week

Pateley hit-and-run: Man charged with two further offences

Pateley hit-and-run: Man charged with two further offences

Opinions sought on new specialist autism school in Harrogate

Opinions sought on new specialist autism school in Harrogate

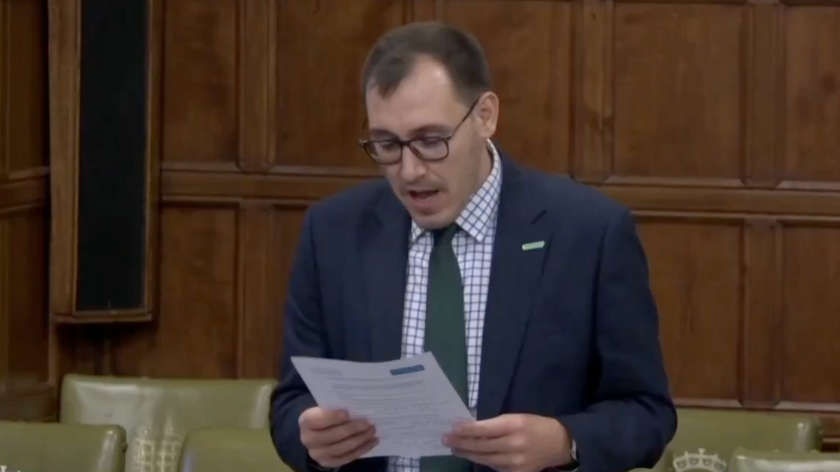

Harrogate MP sparks Parliamentary debate on water bosses flouting bonus ban

Harrogate MP sparks Parliamentary debate on water bosses flouting bonus ban

New sandwich shop opens on Knaresborough Road

New sandwich shop opens on Knaresborough Road

Knaresborough girl named St John Ambulance Badger of the Year

Knaresborough girl named St John Ambulance Badger of the Year

Starbeck fish and chip shop named among best in UK

Starbeck fish and chip shop named among best in UK

Harrogate Library celebrates 120th anniversary

Harrogate Library celebrates 120th anniversary

Pledge to improve quality of Harrogate social homes welcomed by tenants

Pledge to improve quality of Harrogate social homes welcomed by tenants

Historic Harrogate bowling club registered as community asset

Historic Harrogate bowling club registered as community asset